food sales tax in pa

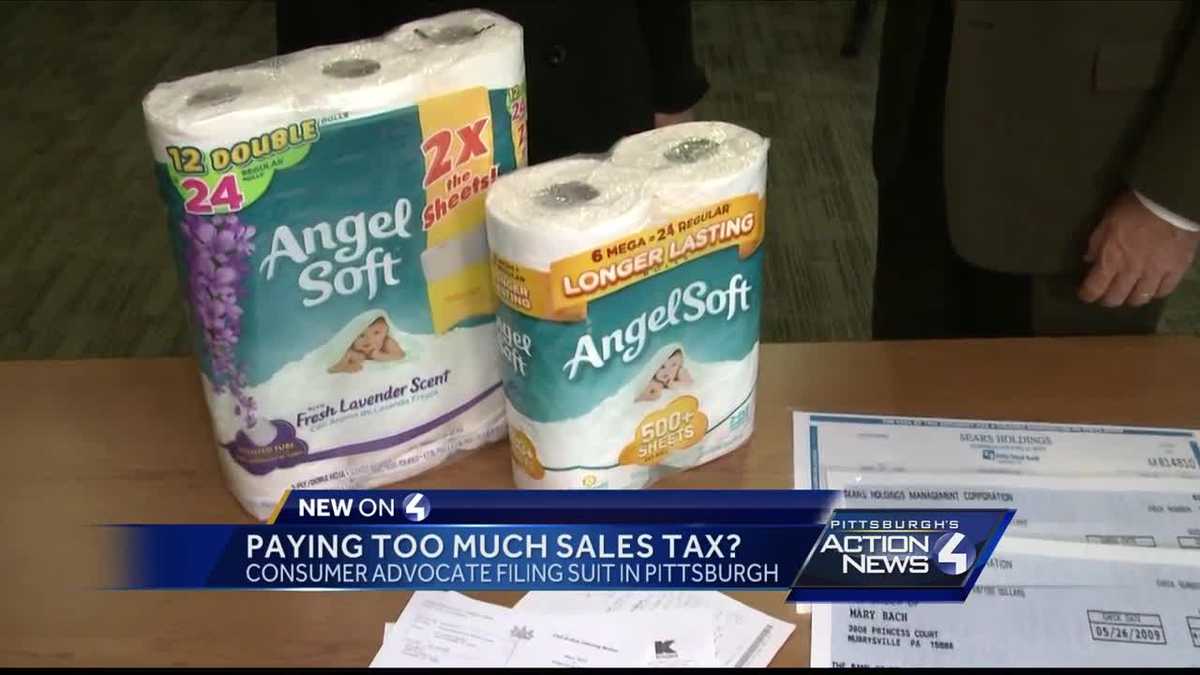

With local taxes the total sales tax rate is between 6000 and 8000. On top of the state sales tax there is a 1 percent local sales tax in Allegheny County and a 2 percent local sales tax in Philadelphia.

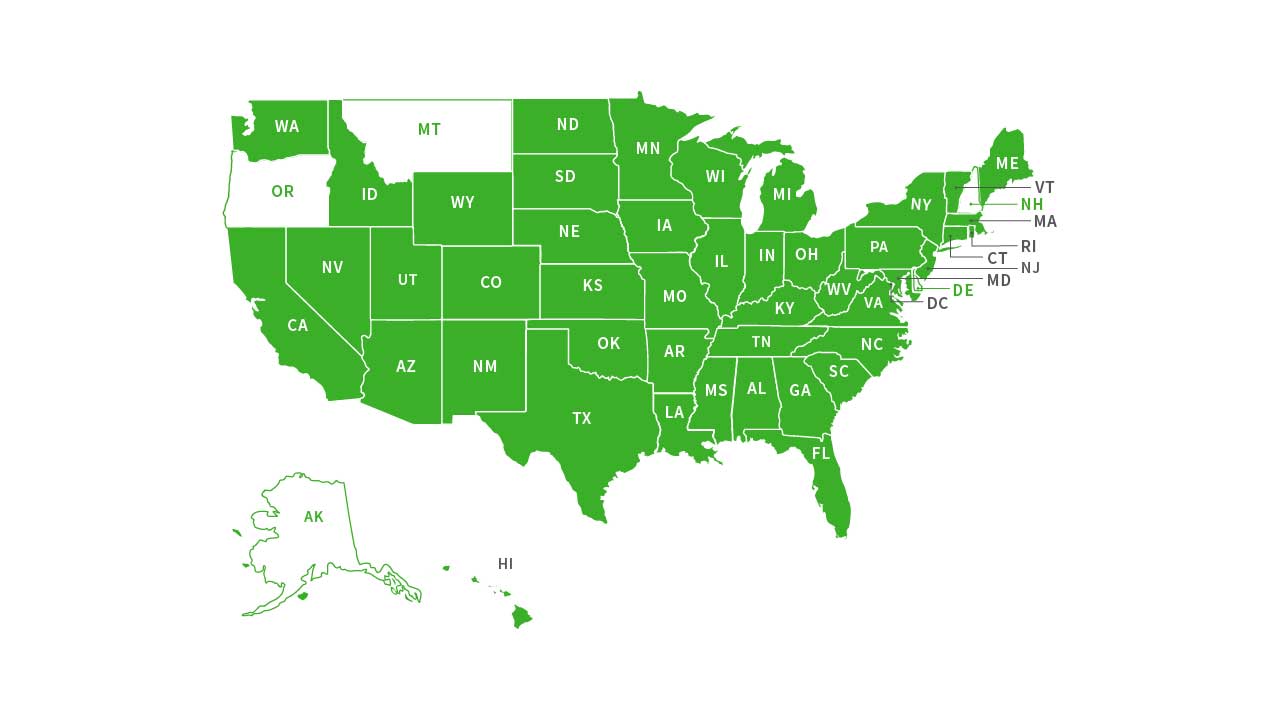

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

6 Sale of food and beverages at or from a school or church.

. Code 521 and 581 relating to purchases of medicines medical supplies medical equipment and prosthetic or therapeutic. I A tax-exempt organization under section 501c3 of the Internal. Food fruit drinks soft drinks and sandwiches purchased with food stamps Food supplements in any form Fruit drinks noncarbonated or reconstituted containing at least 25 natural fruit juice.

Is food taxable in Pennsylvania. Eight-digit Sales Tax Account ID Number. 31 rows The state sales tax rate in Pennsylvania is 6000.

To verify your Entity Identification Number contact the e-Business Center at 717-783-6277. 7805 Saturday December 11 2021 The Department of Revenue Department is hereby giving notice to the public in accordance with the provisions of 61 Pa. While Pennsylvanias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

This page describes the taxability of food and meals in Pennsylvania including catering and grocery food. The PA use tax only applies to certain purchases. B Three states levy mandatory statewide local add-on sales taxes.

1 The food is not potentially hazardous food. All food and beverages non-alcoholic in any quantity including both food and beverages prepared on the premises and prepackaged food and beverages. DEPARTMENT OF REVENUE Notice of Taxable and Exempt Property 51 PaB.

The Pennsylvania use tax should be paid for items bought tax-free over. The sale of food or beverage items by D from the restaurant is subject to tax. Alabama Prepared food to be consumed on or off the premises is taxable.

We include these in their state sales. To learn more see a full list of taxable and tax-exempt items in Pennsylvania. Arizona Prepared food to be consumed on or off the premises is taxable.

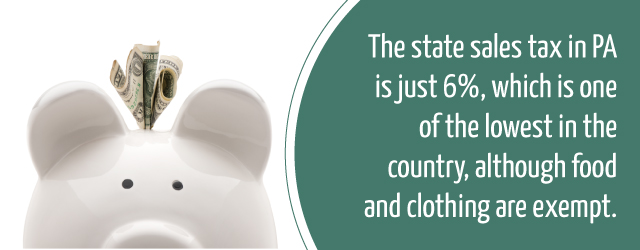

See the Retailers Information Guide REV-717 or the more detailed Taxability Lists for a taxable items to review subjectivity to sales tax of goods and services. Pennsylvanias sales tax can be very confusing. The Pennsylvania sales tax rate is 6 percent.

The latest sales tax rate for Pittsburgh PA. A vending machine delicatessen grocery store supermarket farmers market bakery donut shop pastry shop convenience store and other similar establishments selling the following taxable items whether sold for consumption on or off the premises or on a take-out or to-go basis or delivered is considered to be an eating establishment. Wine sold for consumption off premises or on a to-go basis.

California 1 Utah 125 and Virginia 1. Pennsylvania has a 6 statewide sales tax rate but also has 68 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0166 on top of the state tax. 2022 Pennsylvania state use tax.

Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services. Generally the sale of food or beverages by a school or church is exempt from tax if the sales are in the ordinary course of the activities of the school or church. By Jennifer Dunn August 24 2020.

Pennsylvania first adopted a general state sales tax in 1953 and since that time the rate has risen to 6 percent. Thus the total cost of sales tax is 371 2100 sales tax. Most people know the rules about food and clothing generally being exempt but state law details hundreds of categories and identifies those items.

Nine-digit Federal Employer Identification Number or Social Security number or your 10-digit Revenue ID. 2020 rates included for use while preparing your income tax deduction. In most cases food sold by food trucks is fully taxable and you should simply charge sales tax at the location where you make the sale.

Contact the PA Department of Revenue with further questions. The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is 634. Tax is paid at time of purchase from a Liquor Control Board store or licensed malt beverage distributor.

2 The food is used or offered for human consumption by any of the following organizations. Select the Pennsylvania city from the list of popular cities below to see its current sales tax rate. The following is what you will need to use TeleFile for salesuse tax.

- Shell eggs must meet Pennsylvania Egg Refrigeration Law standards - Some pre-packaged potentially hazardous food items are subject to PA sales tax. These are typically products that are considered ready-to-eat and do not include pre-packaged meat eggs cheese or milk. I Schools and churches.

This can get tricky with products like food which are often considered necessities when bought at the grocery store but not so much when bought at restaurants. By law a 1 percent local tax is added to purchases made in Allegheny County and 2 percent local tax is added to purchases made in Philadelphia. This rate includes any state county city and local sales taxes.

This means that depending on your location within Pennsylvania the total tax you pay can be significantly higher than the 6 state sales tax. When calculating the sales tax for this purchase Steve applies the 6 tax rate for Pennsylvania with no other forms of sales tax due to Pennsylvania not having city county or local sales tax applications. Grocery items are also taxable.

In the US each state makes their own rules and laws about what products are subject to sales tax. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 8.

Resources Blog Food. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Pennsylvania sales tax. The Pennsylvania use tax is a special excise tax assessed on property purchased for use in Pennsylvania in a jurisdiction where a lower or no sales tax was collected on the purchase.

Food prepared in a private home may be used or offered for human consumption in a retail food facility if the following apply. 53 rows Table 1. The December 2020 total local sales tax rate was also 7000.

Pennsylvania Sales Tax Handbook 2022

Pennsylvania Cottage Food Law Forrager

Is Food Taxable In Pennsylvania Taxjar

How To Get An Exemption Certificate In Pennsylvania Startingyourbusiness Com

Pa Lawmaker Introduces Property Tax Elimination Plan That Would Hike Retirement Sales Income Levies Pennlive Com

Is Food Taxable In Pennsylvania Taxjar

Read To Learn More About Why You Should Retire In Pennsylvania Learn More From Cornwall Manor Retirement Budget Retirement Pennsylvania

States With Highest And Lowest Sales Tax Rates

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

Pennsylvania Sales Tax Which Items Are Taxable And What S Exempt

Everything You Don T Pay Sales Tax On In Pennsylvania From Books To Utilities On Top Of Philly News

The Consumer S Guide To Sales Tax Taxjar Developers

Everything You Don T Pay Sales Tax On In Pennsylvania From Books To Utilities On Top Of Philly News

Pennsylvania Sales Tax Small Business Guide Truic

In Which States Are Groceries Tax Exempt Sales Tax Grocery Items Tax

Pennsylvania Sales Tax Which Items Are Taxable And What S Exempt

Sales Tax On Grocery Items Taxjar

Benefits Of Retiring In Pennsylvania Cornwall Manor

Pennsylvania S Quirky Sales Tax System Soft Drinks Are Taxed Candy Gets A Pass Pittsburgh Post Gazette